从开票到支付¶

本章分析OpenERP的会计的基本工作流,从填写发票到确认付款。介绍了具体各种操作,不仅包括填写会计凭证的分录,还有对账过程的账务处理(包括付款单等)。

总帐是公司管理的核心: 公司所有的业务都会影响它。它是一个信息员(有多少现金?什么样的债务需要偿还呢?库存价值多少?),并且,因为它提供的信息,可靠和详细的会计系统可以并且应该有一个重大决策的地位。

In most companies, accounting is limited to producing statutory reports and satisfying the directors’ curiosity about certain strategic decisions, and to printing the balance sheet and the income statement several times a year. Even then, there is often several weeks of delay between reality and the report.

Note

Valueing your Accounting Function

In many small companies, the accounting function is poorly treated.

Not only do you see the data for documents being entered into the system twice, but also the results are often just used to produce legal documents and regular printouts of the balance sheet and income statements some weeks after the closing dates.

By contrast, integrating your accounts with your management system means that you can:

- reduce data entry effort – you only need to do it once,

- run your processes with the benefit of financial vision: for example, in managing projects, negotiating contracts, and forecasting cash flow,

- easily get hold of useful information when you need it, such as a customer’s credit position.

So accounting is too often underused. The information it brings makes it a very effective tool for running the company if it is integrated into the management system. Accounting information really is necessary in all of your company’s processes for you to be effective, for example:

- for preparing quotations it is important to know the precise financial position of the client, and to see a history of any delays in payment,

- if a given customer has exceeded his credit limit, accounting can automatically stop further deliveries to the customer,

- if a project budget is 80% consumed, but the project is only 20% complete, you could renegotiate with the client, or review and rein in the objectives of the project,

- if you need to improve your company’s cash flow then you could plan your service projects on the basis of billing rates and payment terms of the various projects, and not just delivery dates – you could work on short-term client projects in preference to R&D projects, for example.

OpenERP’s general accounting and analytic accounting handle these needs well because of the close integration between all of the application modules. Furthermore, the transactions, the actions and the financial analyses happen in real time, so that you cannot only monitor the situation but also manage it effectively.

The account module in OpenERP covers general accounting, analytic accounting, and auxiliary

and budgetary accounting. It is double-entry, multi-currency and multi-company.

Note

Accounting

- General accounting (or financial accounting) is for identifying the assets and liabilities of the business. It is managed using double-entry accounting which ensures that each transaction is credited to one account and debited from another.

- Analytical accounting (or management accounting, or cost accounting) is an independent accounting system, which reflects the general accounts but is structured along axes that represent the company’s management needs.

- Auxiliary accounting reflects the accounts of customers and/or suppliers.

- Budgetary accounts predefine the expected allocation of resources, usually at the start of a financial year.

Tip

多公司操作

在使用OpenERP多公司操作前, 请参考下面的情形进行配置选择:

- 如果你的多个公司间只共用少部分数据(如产品, 合作伙伴以及其他),推荐你为每个公司独立创建一个帐套,

- 如果你的多个公司间共用比较多的数据,那你就需要在同一个帐套中进行细致的权限规划配置了,

- you can synchronize specified document types in several databases using the

base_synchromodule, which is a shared-funding module rather than a module in the standard open repositories.

One of the great advantages of integrating accounts with all of the other modules is in avoiding the double entry of data into accounting documents. So in OpenERP, an Order automatically generates an Invoice, and the Invoice automatically generates the accounting entries. These in turn generate tax submissions, customer reminders, and so on. Such strong integration enables you to:

- reduce data entry work,

- greatly reduce the number of data entry errors,

- get information in real time and enable very fast reaction times (for bill reminders, for example),

- exert timely control over all areas of company management.

Tip

For Accountants

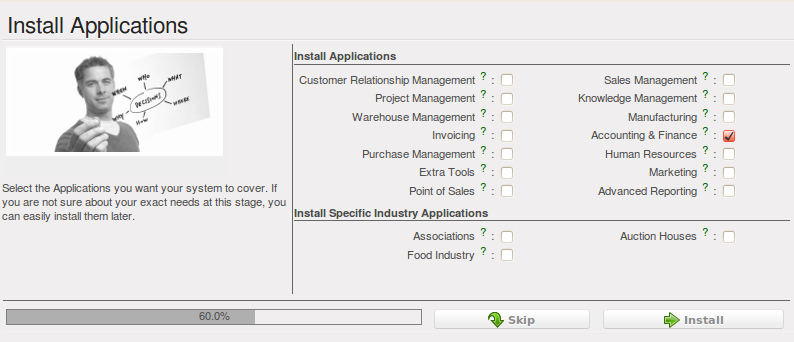

You can configure the Accounting application using the information given in the configuration wizard.

With appropriate rights management, this allows trustees to provide customers with real-time access to their data. It also gives them the opportunity to work on certain documents that have no direct accounting impact, such as budgets.

This can provide a value-added service that greatly improves the interaction between trustees and their clients.

All the accounts are held in the default currency (which is specified in the company definition), but each account and/or transaction can also have a secondary currency (which is defined in the account). The value of multi-currency transactions is then tracked in both currencies.

For this chapter you should start with a fresh database that includes demo data, with Sales Management installed and a generic chart of accounts.