会计分录¶

创建会计分录有多种方法。 比如,你已经清楚地了解了发票是怎么来创建它的分录。

本节讨论

- 银行对账单的管理,

- 现金管理,

- 账簿分录管理。

这里我们给你展示如何进入财务交易。在OPENERP中,你可以处理银行对账单和现金记录。 对这两种交易使用不同的账簿。根据选择的账簿类型,you will have a different screen.

管理银行对账单¶

OpenERP提供了一个可视化的工具来管理银行对账单,简化了账户数据的录入。 当对账单被确认时,OPENERP就会自动生成相应的会计分录。 所以,非会计人员无需担心贷方,借方和counterparts这些事,也可以记录财务事项。

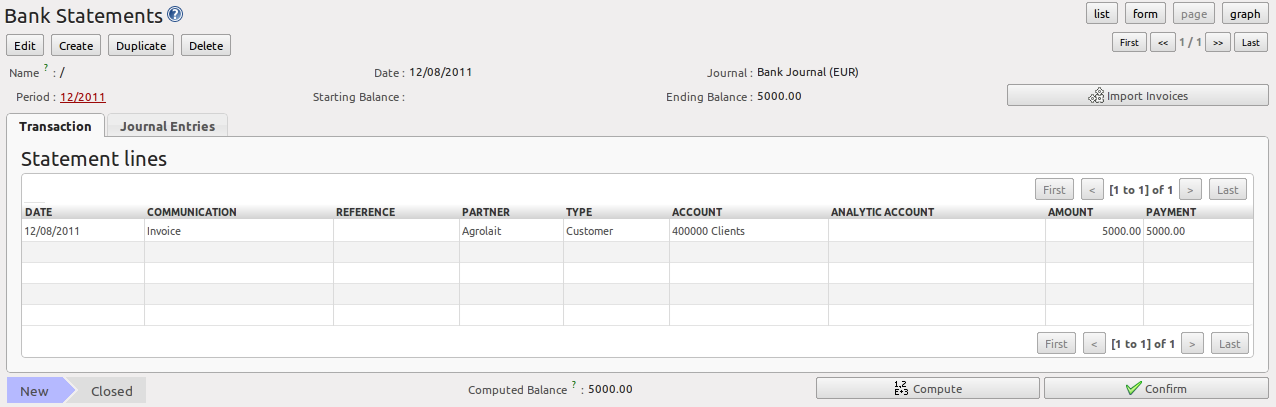

记录一张银行对账单, 转到菜单 。 输入数据到银行对账单的表单然后打开如图所示 银行对账单录入界面.

单据引用的 名称 和 日期 是由OPENERP自动推荐的。这个 名称 在银行对账单确认的时候将被单据编号补充。 你可以通过管理序列号来配置你自己的引用,在 菜单。

接着选择 账簿(Journal). 一般来讲,在期初建立账套的时候,最好为公司的每一个银行账户及现金户各建立一个对应的 账簿(Journal). 然后在这里,你选择与本次银行对账相应的账簿即可.

银行对账单明细行上的币种会沿用对账单所属账簿的币种设置. 如你的银行对帐单明细是 美元(USD), 则你对应应该输入 美元(USD) 的金额. 在确认单据时,非公司本币位的币种会自动按当时有效汇率转换为公司本币位币种. (所以,您必须 首先在 处建立相关币种的汇率)

OpenERP 会自动将上一次对账的余额处理到本次对账单的期初余额中. You can modify this value and force another value. This lets you enter statements in the order of your choice. Also if you have lost a page of your statement, you can enter the following ones immediately and you are not forced to wait for a duplicate from the bank.

So, complete the closing balance which corresponds to the new value in the account displayed on your bank statement. This amount will be used to control the operations before approving the statement.

接着就是按银行的回单逐行输入进银行对帐单明细中.

输入本次对账的所有交易明细行. 你可以手工录入这些交易明细,你也可以点击 导入发票(Import Invoices) 按钮来自动生成交易明细.

手工分录¶

当你输入一个合作者的名字, OpenERP 自动调用相应的中央集权的帐户. The total amount due for the customer or supplier is pre-completed (Amount). This gives you a simple indication of the effective payment. You must then enter the amount that appears on your statement line: a negative sign for a withdrawal and a positive sign for a cash payment or deposit.

在 收/付款(Payment) 界面按下键 F1 会自动将需要核销的凭证行与本次付款对应起来.

导入发票¶

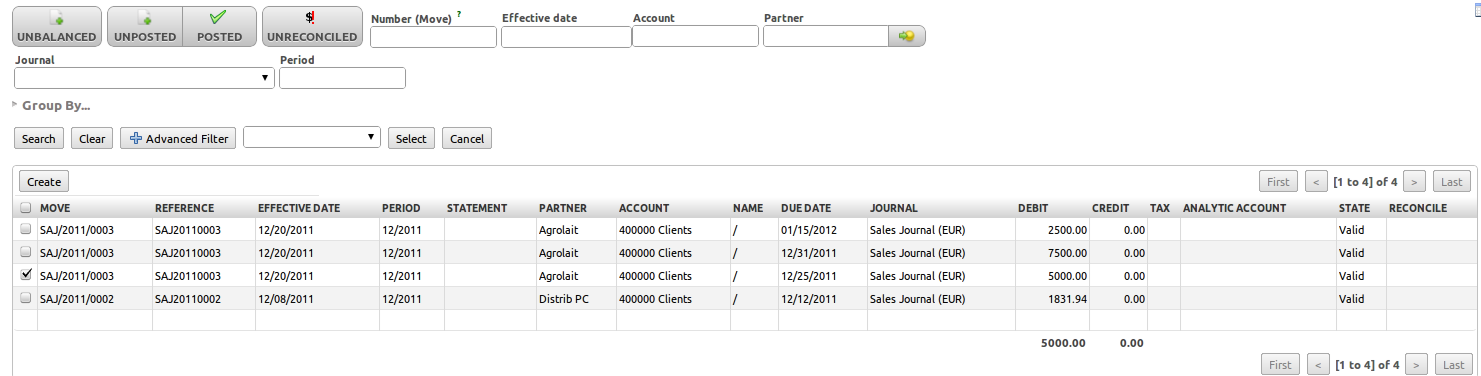

点击 导入发票(Import Invoices) 按钮, 选择你要与付款相核销的发票行,并点击 添加(Add) 按钮. 点击OK确认选择; the statement line will automatically be added with the corresponding reconciliation.

Note

核销

OpenERP 有很多种核销方式: 你可以在支付发票时, 直接选择与之对应的发票相关的凭证行进行核销.也可以 使用 自动核销 工具进行自动核销.

你可以将相关金额全额核销,也可以仅核销一部分.

如果在你的收付款与发票的核销金额不一致时,OpenERP 会进入 销账(Write-off) 向导, 允许你将核销不平衡 余额调账到一个指定的会计科目中去. 通常使用下面的方式去调整余额:

- 记入利润或者亏损,

- 记入汇兑损益,

- 记入销售折扣/回扣/佣金/返利等相关科目.

当付款金额与待付款项和调整科目项之和的金额相符时,就可以完成本次核销.

你还可以选择后面再处理本次核销余额.核销操作会处理两件事:

- 标记发票已核销,

- 防止已清账的支付信息与发票信息的客户提醒支付邮件重复发送, 客户收到的仅是未核销的支付与发票信息. 如果与 客户相互达成一致对某些欠款或者不明款项进行销账,也可以在核销中处理.

然后,你再确认一下. 只要余额平衡OpenERP 会自动生成对应的凭证分录. 对应的相关发票也会自动标记为已支付.

You can also enter general accounting entries, for example, banking costs. In such cases, you can enter the amounts directly in the corresponding general accounts.

A user with advanced accounting skills can enter accounting entries directly into the bank journal from . The result is the same, but the operation is more complex because you must know the accounts to use and must have mastered the ideas of credit and debit.

现金管理¶

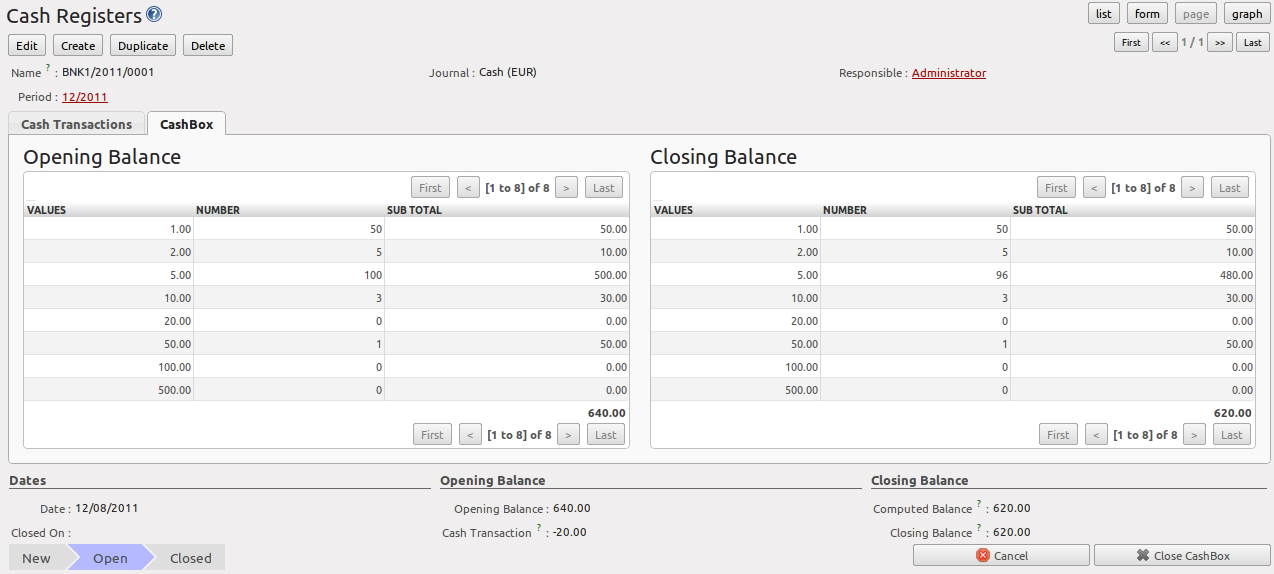

要进入现金管理, 请点击菜单 . 然后每天在 初始余额(Opening Balance) 处输入当前的现金期初盘点.Then open the cashbox to start making entries from the Cash Transactions tab.

All the transactions throughout the day are then entered in this statement. When you close the cashbox, generally at the end of the day, enter the amounts on the CashBox tab, in the 销账(Closing Balance) section. Then confirm the statement to close the day’s cash statement and automatically generate the corresponding accounting entries. Note that the Calculated Balance and the CashBox Balance need to be equal before you can close the cashbox.

Tip

确认对账单

Accounting entries are only generated when the cash statement is confirmed. So if the total statement has not been approved (that is to say during the day, in the case of petty cash), partner payments will not have been deducted from their corresponding account.

管理账簿中的分录¶

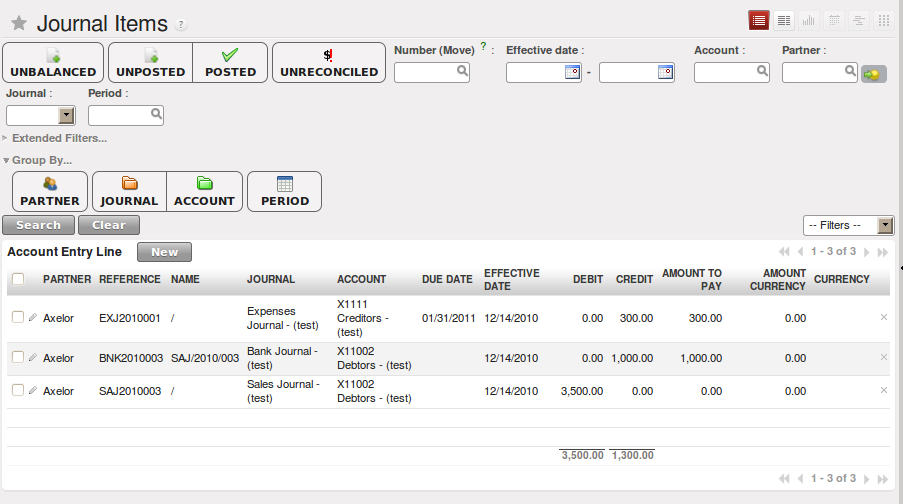

Invoices and statements produce accounting entries in different journals. But you could also create entries directly in a journal (line by line) without using the dedicated journal views. This functionality is often used for miscellaneous entries.

手工录入凭证时,进菜单 . 在 凭证明细列表页 选择适当的 账簿(Journal) 再点击 搜索(Find) 进行过滤. 这时如果你新建凭证行时, 新的凭证行则默认会记账到你过滤选择的账簿.

下面看一下采购发票的例子,在OpenERP中自动生成会计凭证分录.

点击 新建(New) 按钮, 并按下面的内容填写:

- 参考(Reference): 发票及凭证相关的参考信息,

- 发生日期(Effective date): 记账的日期,通常使用操作当天的日期,

- 会计期间(Period): 业务发生时的会计期间, 通常情况下应该是当前的会计期间,

- 合作伙伴(Partner): 与本次业务相关的合作伙伴,

- 科目(Account): 记账科目 (如采购科目

材料采购(Products Purchase)), - 摘要(Name): 发票行的摘要(如:

PC2), - 借方(Debit): 借方的金额.

- 账簿(Journal): 选择要记入的账簿.

- 贷方(Credit): 贷方的金额.

按 回车(Enter) 键保存. 凭证会有一个简单的自动编号.因为凭证借贷方并不平衡,所以录入的数据行都是红色的状态.并且 默认情况下录入的发票行都处于草稿状态,还不会直接影响财务报表数据.因此,你需要将该凭证记账.注意凭证中的凭证行的借贷方的金额 必须平衡.

OpenERP now proposes the balancing accounting line to be filled in. If the account used (in this

case account 600000 ) includes taxes by default OpenERP automatically

proposes taxes associated with the amount entered. At this stage you can modify and validate this

second line of the account, or replace it with other information such as a second purchase line.

When you have entered all of the data from your lines, OpenERP automatically proposes counterpart entries to you, based on the credit entries.

Tip

关于借贷平衡

When an accounting entry is matched, OpenERP moves it to the Valid state automatically and

prepares to enter the next data. Do not forget to definitely post the valid entries by clicking the Action

button and selecting Post Journal Entries.

If you want to add some other balancing lines you can enter the number of the entry on the new line that you are entering. In such a case the whole line stays Draft until the whole set balances to zero.

核销过程¶

The reconciliation operation consists of matching entries in different accounts to indicate that they are related. Generally reconciliation is used for:

- matching invoice entries to payments, so that invoices are marked as paid and customers do not get payment reminder letters for those entries (reconciliation in a customer account),

- matching deposits and cheque withdrawals with their respective payments,

- matching invoices and credit notes to cancel them out.

A reconciliation must be carried out on a list of accounting entries by an accountant, so that the sum of credits equals the sum of the debits for the matched entries.

Reconciliation in OpenERP can only be carried out in accounts that have been configured as reconcilable (the Reconcile field).

Tip

Do not confuse account reconciliation and bank statement reconciliation

It is important not to confuse the reconciliation of accounting entries with bank statement reconciliation. Account reconciliation consists of linking account entries with each other, while statement reconciliation consists of verifying that your bank statement corresponds to the entries of that account in your accounting system. You can perform statement reconciliation using the menu .

There are different methods of reconciling entries. You have already seen the reconciliation of entries while doing data entry in an account. Automatic and manual reconciliations are described here.

自动核销¶

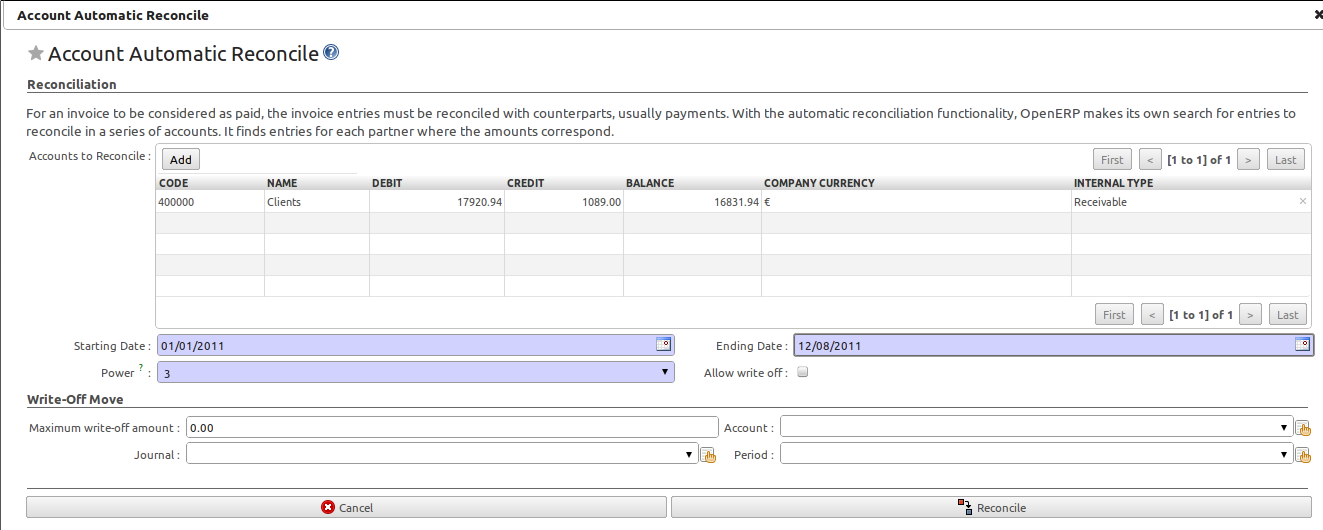

自动核销是让OpenERP自动从凭证行中按每个合作伙伴检索出金额相符的对应的双向凭证并标记为已核销.

Depending on the level of complexity that you choose (= power) when you start running the tool, the software could reconcile from two to nine entries at the same time. For example, if you select level 5, OpenERP will reconcile, for instance, three invoices and two payments if the total amounts correspond. Note that you can also choose a maximum write-off amount, if you allow payment differences to be posted.

To start the reconciliation tool, click .

自动核销弹出窗口后, 填写如下数据:

- 核销科目(Accounts to Reconcile) : 选你将要核销的一个,几个甚至全部可以允许核销的科目,

- 需要核销的数据时间范围 (起始日期(Starting Date) / 结束日期(Ending Date)),

- the Reconciliation Power (from

2to9), - 允许销账(Allow write off) 是否将核销借贷方的差异进行销账处理.

- information needed for the adjustment (details for the Write-Off Move).

Note

Reconciling

You can reconcile any account, but the most common accounts are:

- all the Accounts Receivable – your customer accounts of type Debtor,

- all the Accounts Payable – your supplier accounts of type Creditor.

The write-off option enables you to reconcile entries even if their amounts are not exactly equivalent. For example, OpenERP permits foreign customers whose accounts are in different currencies to have a difference of up to, say, 0.50 units of currency and put the difference in a write- off account.

Tip

Limit Write-off Adjustments

You should not make the adjustment limits too large. Companies that introduced substantial automatic write-off adjustments have found that all employee expense reimbursements below the limit were written off automatically!

Note

默认值

If you run the automatic reconciliation tool regularly, you should set default values for each field by using the right-click mouse button in the web client (in edit mode) or the GTK client. The resulting context menu enables you to set default values. This means that you will not have to retype all the fields each time.

手工核销¶

For manual reconciliation, open the entries for reconciling an account through the menu .

You can also call up manual reconciliation from any screen that shows accounting entries.

Select entries that you want to reconcile. OpenERP indicates the sum of debits and credits for the selected entries. When these are equal you can click the Reconcile Entries button to reconcile the entries.

Note

Example Real Case of Using Reconciliation

Suppose that you are entering customer order details. You wonder what is outstanding on the customer account (that is the list of unpaid invoices and unreconciled payments). To review it from the order form, navigate to the Partner record and select the view Receivables and Payables. OpenERP opens a history of unreconciled accounting entries on screen.

Unreconciled Accounting Entries

After running the Reconcile Entries wizard, these lines can no longer be selected and will not appear when the entries are listed again. If there is a difference between the two entries, OpenERP suggests you to make an adjustment. This “write-off” is a compensating entry that enables a complete reconciliation. You must therefore specify the journal and the account to be used for the write-off.

For example, if you want to reconcile the following entries:

| Date | Ref. | Description | Account | Debit | Credit |

|---|---|---|---|---|---|

| 12 May 11 | INV23 | Car hire | 4010 | 544.50 | |

| 25 May 11 | INV44 | Car insurance | 4010 | 100.00 | |

| 31 May 11 | PAY01 | Invoices n° 23, 44 | 4010 | 644.00 |

On reconciliation, OpenERP shows a difference of 0.50. At this stage you have two possibilities:

- do not reconcile, and the customer receives a request for 0.50,

- reconcile and accept an adjustment of 0.50 that you will take from the P&L account.

OpenERP generates the following entry automatically:

| Date | Ref. | Description | Account | Debit | Credit |

|---|---|---|---|---|---|

| Date | Ref. | Description | Account | Debit | Credit |

| 03 Jun 11 | AJ001 | Adjustment: profits and losses | 4010 | 0.50 | |

| 03 Jun 11 | AJ001 | Adjustment: profits and losses | XXX | 0.50 |

The two invoices and the payment will be reconciled in the first adjustment line. The two invoices will then be automatically marked as paid.

支付管理¶

OpenERP gives you forms to prepare, validate and execute payment orders. This enables you to manage issues such as:

- Payment provided on several due dates.

- Automatic payment dates.

- Separating payment preparation and payment approval in your company.

- Preparing an order during the week containing several payments, then creating a payment file at the end of the week.

- Creating a file for electronic payment which can be sent to a bank for execution.

- Splitting payments depending on the balances available in your various bank accounts.

如何管理你的付款单¶

To use the tool for managing payments you must first install the module account_payment, or install Supplier Payments from the Configuration Wizard.

It is part of the core OpenERP system.

The system lets you enter a series of payments to be carried out from your various bank accounts. Once the different payments have been registered, you can validate the payment orders. During validation you can modify and approve the payment orders, sending the order to the bank for electronic funds transfer.

For example, if you have to pay a supplier’s invoice for a large amount you can split the payments amongst several bank accounts according to their available balance. To do this, you can prepare several draft orders and validate them once you are satisfied that the split is correct.

This process can also be regularly scheduled. In some companies, a payment order is kept in Draft

state and payments are added to the draft list each day. At the end of the week, the accountant

reviews and confirms all the waiting payment orders.

Once the payment order is confirmed, there is still a validation step for an accountant to carry out. You could imagine that these orders would be prepared by an accounts clerk, and then approved by a manager to go ahead with payment.

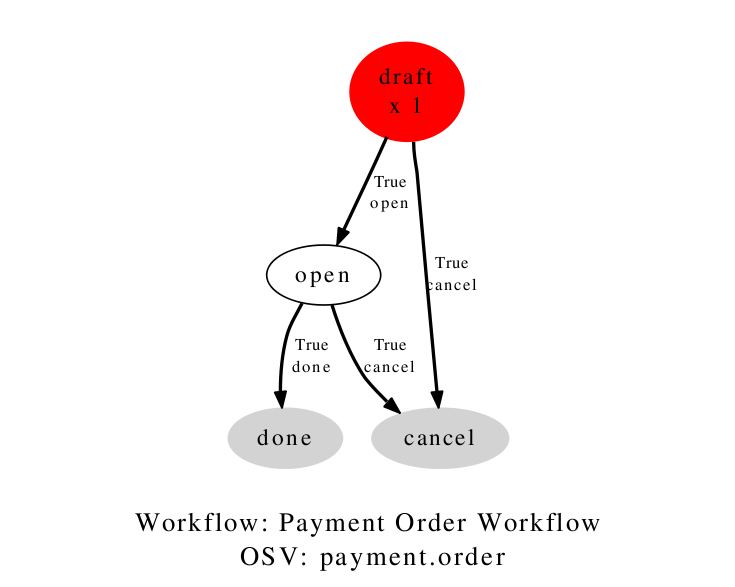

Tip

Payment Workflow

An OpenERP workflow is associated with each payment order. Select a payment order, and if you are in the GTK client click from the top menu.

You can integrate more complex workflow rules to manage payment orders by adapting the workflow. For example, in some companies payments must be approved by a manager under certain cash flow or value limit conditions.

In small businesses it is usually the same person who enters the payment orders and who validates them. In this case you should just click the two buttons, one after the other, to confirm the payment.

准备和传输付款单¶

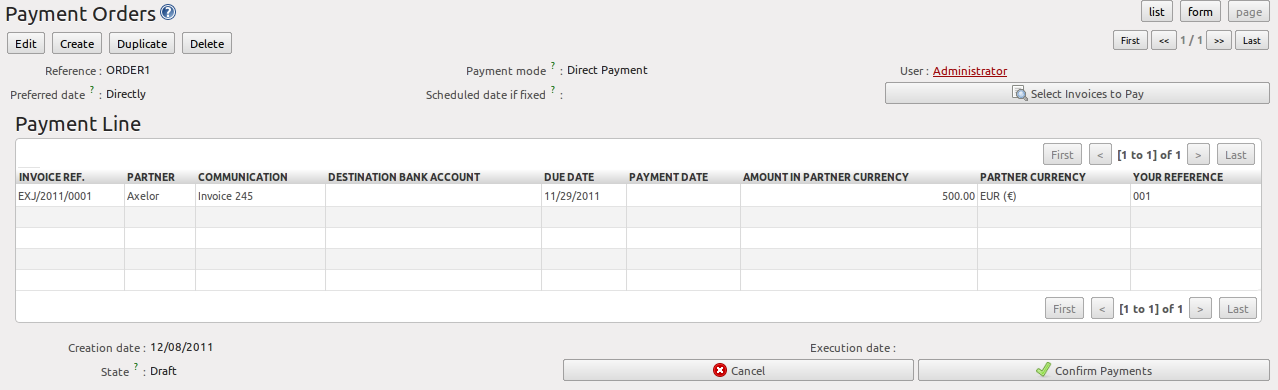

To enter a payment order, use the menu .

OpenERP then proposes a reference number for your payment order.

You then have to choose a payment mode from the various methods available to your company. These have to be configured when you set up the accounting system using the menu . Some examples are:

- Cheques

- Bank transfer,

- Visa card on a bank account,

- Petty cash.

Then, you set the Preferred date for payment:

Due date: each operation will be effected at the invoice deadline date,Directly: the operations will be effected when the orders are validated,Fixed date: you must specify an effective payment date in the Scheduled date if fixed field that follows.

The date is particularly important for the preparation of electronic transfers, because banking interfaces enable you to select a future execution date for each operation. So to configure your OpenERP, most simply you can choose to pay all invoices automatically by their deadline.

You must then select the invoices to pay. They can be entered manually in the field Payment Line, but it is easier to add them automatically. For that, click Select Invoices to Pay and OpenERP will then propose lines with payment deadlines. For each deadline you can see:

- the invoice Payment Date,

- the reference Invoice Ref.,

- the deadline for the invoice,

- the amount to be paid in the partner’s default currency.

You can then accept the payment proposed by OpenERP, or select the entries that you will pay or not pay on that order. OpenERP gives you all the necessary information to make a payment decision for each line item:

- account,

- supplier’s bank account,

- amount that will be paid,

- amount to pay,

- the supplier,

- total amount owed to the supplier,

- due date,

- date of creation.

You can modify the first three fields on each line: the account, the supplier’s bank account and the amount that will be paid. This arrangement is very practical because it gives you complete visibility of all the company’s trade payables. You can pay only a part of an invoice, for example, and in preparing your next payment order OpenERP automatically suggests payment of the remainder owed.

When the payment has been prepared correctly, click Confirm Payments. The payment then changes to

the Confirmed state and a new button appears that can be used to start the payment process.

In future versions of OpenERP, it is expected that the system will be able to prepare and print cheques.

As usual, you can change the start point for the payment workflow from the menus.